Used-aircraft prices have declined less than expected despite a +50% decrease in transactions relative to 2019

2020 Corporate Aviation Market Recap

2020 Market Recap

- Aircraft values have declined ~10% relative to pre-COVID pricing, though large cabin jets have experienced larger declines.

Header 1

If you have bought or sold an aircraft this year, you likely have heard about the red hot used-aircraft market. As aircraft brokers, we had a front row view to the massive increase in demand that hit the market. Now that we are approaching year end, we finally had a moment to breathe and take a look at used aircraft transaction data to figure out what changed in the market.

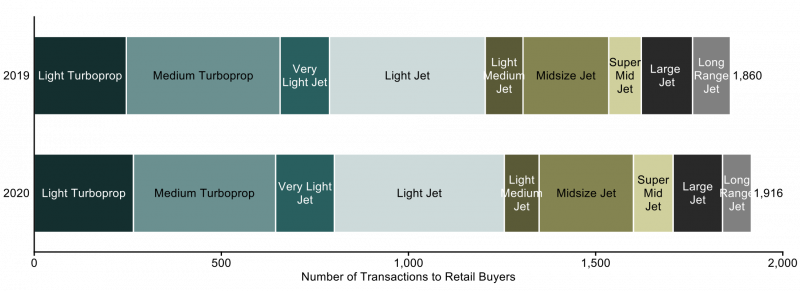

Corporate Aircraft Transactions to Retail Buyers

At the 30,000-foot level, our anecdotal experiences with unprecedented demand have been entirely supported by the data. Through the end of November, we are on-pace to see more deals completed in 2020 than in 2019. As a note – all data in this post will include November transactions, but will exclude December as we only have partial data.

The used-aircraft market had a strong start to the year, but the COVID-19 pandemic created uncertainty that hit the market like a brick wall. Transaction counts were down nearly 50% year-over-year in March and April and inventory was stagnating.

Then a flip switched in June and deals were happening again. We saw six straight months of growth in deal volumes relative to the prior year. In addition to higher deal volumes, we saw aircraft values rise 10-15% as a growing number of buyers competed for a limited number of aircraft. Deal terms also became much more favorable to sellers. Buyers had to limit their pre-purchase inspections and conform to seller-defined timelines.

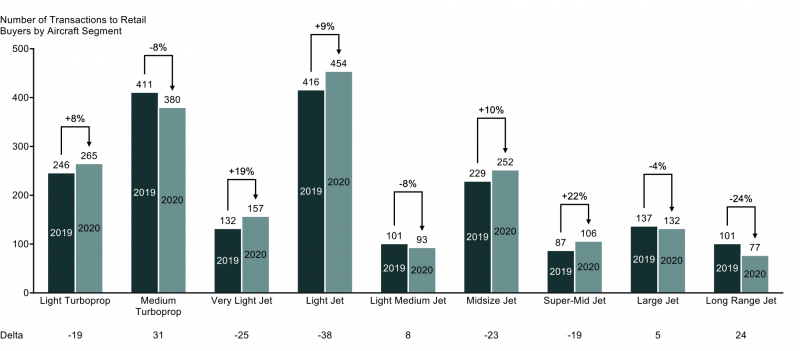

Corporate Aircraft Transactions by Aircraft Segment

Aircraft Segment Analysis

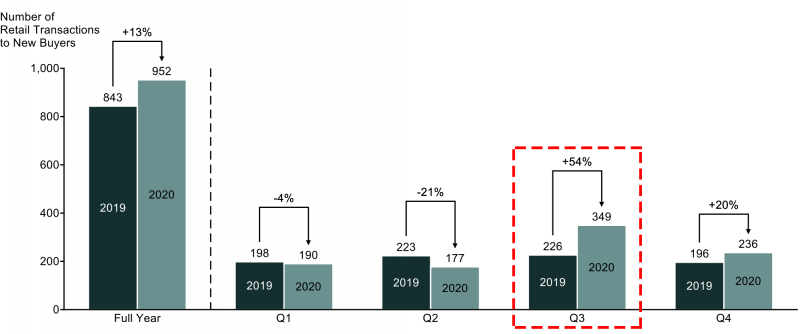

Corporate Aircraft Transactions by Buyer's Purchase Frequency

Based on our analysis, the primary driver for increased deal volumes was an influx of first-time turbine aircraft owners1. In total, first-time aircraft buyers represent nearly half of all deals completed in 2020.

Year-over-Year Change in New Buyer Transactions

We estimate an additional ~180 first time buyers entered the market through November 2020, which represents a ~25% increase relative to 2019. In the 3rd quarter – nearly 340 first-time buyers made an aircraft purchase, which is a ~70% Y/Y increase. The shockwave we felt in the market was the surge of all these buyers coming to the table at the exact same time. This created significant competition for limited inventory, ultimately resulting in a spike in values.

New Buyer Deal Mix

Based on preliminary data, it appears that the 2020 cohort of first-time aircraft owners is very similar to past cohorts of first-time buyers. The 2020 cohort bought the same types of aircraft in the same proportions as 2019 first-time buyers. The only thing that changed was that the overall volume was higher in 2020.

In terms of future impact – you may be wondering how the active market in 2020 will impact the market in 2021. Our crystal ball isn’t perfect, so we’ll provide the two mostly likely outcomes we see for the market.

Scenario 1: Return to Normalcy

The first scenario we believe could happen is a return to a normal state of affairs in the used-aircraft world. The main drivers for this scenario are the distribution of the COVID-19 vaccine, growth of commercial airline service, and a reduction of tax-motivated buyers.

In this scenario, the value of private aircraft would decrease given the improved safety and availability of the airlines. Additionally, the expiration of the CARES Act tax benefits would contribute to a reduction in demand.

As a whole, demand for private aircraft will recede, inventories will increase to their historic levels, and aircraft values would return to their pre-COVID levels.

Scenario 2: Continued Demand Keeps the Market Hot

In contrast to the first scenario we presented, we believe the groundwork has been laid for the hyper-active market of 2020 to continue into 2021.

The main drivers of this scenario are: (1) continued interest in private aviation from first-time buyers, (2) residual demand in the market from repeat buyers that opted out of the 2020 euphoria, and (3) depleted aircraft inventories that have not yet recovered from the recent flood of deals.

Despite the distribution of the COVID-19 vaccine, we could see continued adoption of private aviation by first-time buyers. The pandemic forced many individuals and businesses with mission critical travel needs to experiment with private aviation for the first time via charter or fractional solutions. These groups may transition from a non-ownership solution to full aircraft ownership once they recognize the cost savings associated with ownership, particularly as travel demand ramps up. A business that chartered for 25 hours during the pandemic may see their need for flight hours increase by 3-4x as travel returns to normal. At that point, it will likely be more cost-efficient to buy an aircraft and fly for 100 hours rather than charter for 100 hours. The net result could be a continued increase in first-time aircraft buyers.

In regard to repeat aircraft buyers – we believe there is a large number of repeat buyers on the sidelines. We have advised many of our clients that did not have a tax-situation to wait until 2021 to make a purchase because the market was overheated. Based on the withdrawal of experienced owners from the market, this was likely standard advice. Unfortunately, the result of this advice could be a glut of buyers on the sidelines waiting until 12:00AM on January 1st, 2021 to make their move.

Moving to the supply side of the used-aircraft market – we have not yet seen aircraft inventories return to their historical averages. Many markets are entirely picked over. The best example of this is the Cessna Citation CJ3 market. During the pandemic there were nearly 40 CJ3s actively being sold on Controller.

As of December 21, 2020 do you know how many CJ3s there are for sale? There are eight CJ3s, and half of them are international aircraft. It will take several months for CJ3 inventories to increase, particularly if demand stays high. Competition for CJ3s will remain high as long as supply is low.

In summary, we can very easily envision a scenario in 2021 in which the market stays hot and aircraft values stay elevated relative to pre-pandemic values.